The Greatest Guide To Eb5 Investment Immigration

The Greatest Guide To Eb5 Investment Immigration

Blog Article

Excitement About Eb5 Investment Immigration

Table of Contents9 Easy Facts About Eb5 Investment Immigration ShownSome Known Details About Eb5 Investment Immigration Rumored Buzz on Eb5 Investment ImmigrationUnknown Facts About Eb5 Investment ImmigrationThe smart Trick of Eb5 Investment Immigration That Nobody is Discussing

While we make every effort to provide exact and up-to-date web content, it ought to not be considered legal recommendations. Migration laws and guidelines undergo change, and individual situations can differ extensively. For personalized guidance and legal guidance concerning your specific immigration situation, we strongly recommend speaking with a qualified immigration attorney who can offer you with customized help and make certain conformity with current laws and policies.

Citizenship, via investment. Presently, since March 15, 2022, the amount of financial investment is $800,000 (in Targeted Employment Areas and Country Areas) and $1,050,000 somewhere else (non-TEA zones). Congress has actually approved these amounts for the following 5 years starting March 15, 2022.

To get the EB-5 Visa, Investors need to develop 10 full-time U.S. tasks within two years from the day of their complete investment. EB5 Investment Immigration. This EB-5 Visa Demand makes certain that investments contribute directly to the U.S. job market. This uses whether the tasks are produced straight by the business or indirectly under sponsorship of an assigned EB-5 Regional Facility like EB5 United

Eb5 Investment Immigration Can Be Fun For Anyone

These tasks are figured out via models that make use of inputs such as advancement costs (e.g., construction and equipment expenses) or annual incomes produced by recurring operations. On the other hand, under the standalone, or direct, EB-5 Program, only straight, full-time W-2 worker settings within the commercial venture may be counted. A vital danger of counting exclusively on direct employees is that personnel decreases because of market conditions can cause inadequate full time settings, potentially leading to USCIS rejection of the financier's petition if the task creation need is not fulfilled.

The financial design after that projects the number of direct jobs the new business is likely to produce based on its anticipated revenues. Indirect jobs calculated through financial versions describes work produced in industries that provide the products or services to the company directly involved in the task. These jobs are created as a result of the increased need for items, products, or solutions that sustain business's procedures.

The Main Principles Of Eb5 Investment Immigration

An employment-based 5th preference category (EB-5) financial investment visa gives a method of ending up being a permanent united state local for foreign nationals wishing to spend capital in the United States. In order to obtain this permit, a foreign financier has to spend $1.8 million (or $900,000 in official website a Regional Center within a "Targeted Work Location") and create or protect a minimum of 10 full-time work for United States workers (leaving out the financier and their immediate household).

This action has been a remarkable success. Today, 95% of all EB-5 resources is raised and invested by Regional Centers. Given that the 2008 monetary situation, accessibility to resources has been restricted and municipal budget plans proceed to encounter considerable shortages. In numerous regions, EB-5 investments have actually filled the funding void, providing a new, crucial source of funding for neighborhood economic development jobs that renew communities, produce and sustain work, facilities, and services.

Indicators on Eb5 Investment Immigration You Should Know

employees. Additionally, the Congressional Budget Office (CBO) racked up the program as profits neutral, with administrative costs spent for by candidate costs. EB5 Investment Immigration. Even more than 25 countries, including Australia and the UK, use similar programs to attract international financial investments. visit our website The American program is a lot more strict than many others, calling for considerable danger for investors in regards to both their monetary investment and immigration standing.

Households and people who seek to relocate to the United States on an irreversible basis can apply for the EB-5 Immigrant Investor Program. The United States Citizenship and Immigration Solutions (U.S.C.I.S.) established out numerous requirements to obtain long-term residency with the EB-5 visa program.: The initial step is to locate a certifying financial investment opportunity.

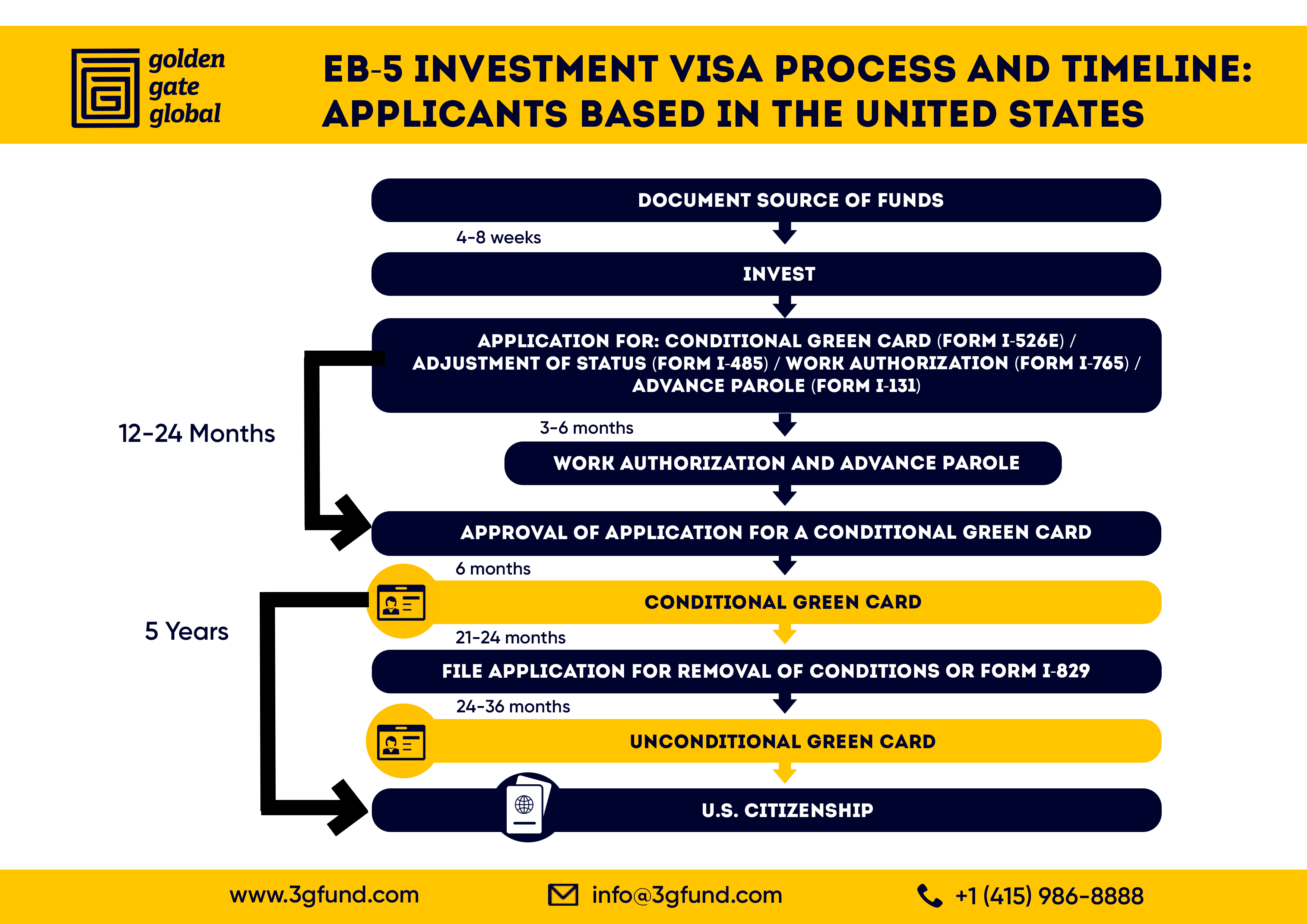

Once the chance has actually been identified, the investor should make the investment and submit an I-526 request to the U.S. Citizenship and Migration Provider (USCIS). This application has to include proof of the financial investment, such as financial institution statements, purchase arrangements, and service plans. The USCIS will review the I-526 petition and either accept it or demand added proof.

The Buzz on Eb5 Investment Immigration

The capitalist needs to request conditional residency by sending an I-485 request. This petition needs to be sent within six months of the I-526 approval and have to consist of proof that the financial investment was made which it has created at least 10 full-time work for U.S. workers. The USCIS will examine the I-485 petition and either accept it or demand additional proof.

Report this page